Best Credit Repair Companies in 2024

Credit repair companies play a pivotal role in helping consumers improve their credit scores, offering a range of services to facilitate fast credit repair. These top-tier firms combine personalized strategies, industry experience, and a comprehensive understanding of credit repair services to deliver effective solutions that cater to individual needs. They empower clients with the knowledge and tools necessary for DIY credit repair, enabling them to take charge of their financial health. Through a combination of expertise, commitment to client success, and ASAP credit repair, these companies have earned their reputation as the best in the industry, transforming lives and credit profiles across the nation.

What is A Credit Repair Service?

A credit repair service is a company that offers to help consumers improve their credit scores by disputing inaccurate or incomplete information on their credit reports, negotiating with creditors and collection agencies, and providing credit counseling or education. Credit repair services may also offer credit monitoring tools to help consumers track changes to their credit scores and reports.

Credit repair services typically work by reviewing a consumer’s credit reports from the three major credit bureaus (Equifax, Experian, and TransUnion), identifying any errors or discrepancies, and disputing them with the three credit bureaus, and creditors on behalf of the consumer. The credit repair service may also negotiate with creditors to remove negative items from a consumer’s credit report, or work with collection agencies to settle outstanding debts.

While some credit repair services may be reputable and effective, it’s important for consumers to carefully evaluate any service they are considering, as there are many fraudulent and misleading companies in the credit repair industry. Some red flags to watch out for with most credit repair companies and journey include promises of guaranteed credit score improvement, requests for upfront payment before any services are provided, and attempts to persuade consumers to dispute accurate information on their credit reports.

Consumers should also be aware that they have the right to dispute inaccurate information on their credit reports themselves, free of charge, and that credit repair services cannot legally remove accurate information from a consumer’s credit report.

Credit Repair Services

Most reputable credit repair companies offer a variety of credit repair services to help fix your credit. Keep in mind that not all the credit repair services that are listed below are offered by all the credit repair companies. We recommend you shop and compare services before choosing a credit repair company. You might conclude that it’s better for you to use a DIY credit repair service over hiring a third party company, especially since nobody cares more about your credit, than you. There are tools available that you can utilize that may super exceed what the third party credit repair companies use.

Collections

A collection can result from a debt that has not been paid on time. The collection agency will then attempt to recover the money owed. While different creditors and lenders have different policies, many credit card accounts are sent to a collection agency after 180 days of non-payment.

Identity Theft

Identity theft and identity fraud are terms used to refer to all types of crime in which someone wrongfully obtains and uses another person’s personal data in some way that involves fraud or deception, typically for economic gain. Identity theft is one of fastest growing crimes.

Duplicates

A duplicate credit entry means that your credit account information has been recorded more than once. Therefore, it appears to be two separate accounts. This could hurt you because it may appear that you have more debt than you do. Lenders turned down often base on this metric.

Outdated Information

If there’s a mistake or outdated information on your credit, we can dispute your credit report with the credit bureau showing the wrong info. It’s smart to get your free annual credit reports from each of the three credit reporting agencies every year.

Junk Debt Buyers

A common example of junk debt is credit card debt that a private company purchases from banks, or another original creditor. Original creditors or junk-debt buyers can sue the borrower for the money….quick list: title: Don’t ignore a lawsuit.

Late Payments

A late payment is an amount of money a borrower sends to a lender or service provider that arrives after the date that the payment was due or after a grace period for the payment has passed. More importantly if more than 30 days past due.

Excessive Inquires

Too many “hard inquiries” will hurt your credit scores, since lenders view that as an early sign of risk. It can look like you’re overextending yourself and taking on more financing than you’ll ultimately be able to afford.

Foreclosures/Short Sale

Foreclosure happens when you default on your mortgage and your lender takes ownership of the home. A foreclosure stays on your credit reports for seven years from the date of the first missed payment, bringing down your credit score.

Tax Liens

Tax liens used to appear on your credit reports maintained by the three national credit bureaus (Experian, TransUnion and Equifax). Even if you paid the lien, it stayed on your reports for up to seven years, while unpaid liens remained 10 years.

Judgements

Judgment. Currently, civil judgments do not appear on your credit reports at all. Yet this change was due to a settlement the credit bureaus made (more on that below). The FCRA still allows judgments to remain on credit reports for seven years from the filing date.

Debt Management/CCCS

CCCS stands for Consumer Credit Counseling Services. Consumer credit counseling service agencies are Internal Revenue Service 501(c)93) nonprofit organizations that will help you find a workable solution to financial problems. This can view negatively by creditors.

Joint Credit/Ex-Spouse

Divorce doesn’t dissolve the joint accounts you opened with your ex nor does it remove them from your credit reports. … In fact, a high credit utilization rate on a joint credit card could hurt the credit scores of both you and your ex, even if all payments are kept on time.

Mixed Credit Files

A mixed credit file occurs whenever a CRA inadvertently commingles the credit histories of two different individuals into a single report. The result is a credit report that contains information belonging to two different consumers, bundled together as if those two people were the same person.

Bankruptcies

The bankruptcy public record is deleted from the credit report either seven years or 10 years from the filing date of the bankruptcy, depending on the chapter you filed. Chapter 13 bankruptcy is deleted seven years from the filing date because it requires at least a partial repayment of the debts you owe.

Inflated Debts

If you don’t pay a collection account, it may wind up with a second — or third — collection agency, resulting in multiple negative items on your credit reports. Sometimes referred to as “double jeopardy,” two or three collection accounts for the same debt can affect your credit scores.

No Credit Scores

No credit, on the other hand, means you haven’t had any recent credit activity that the credit bureaus can use to generate a credit score. No one actually has a credit score of zero, even if they have a troubled history with credit. The FICO scoring model, for instance, ranges between 300 and 850.

24/7/365 Access Portal

Our client portal is a secure digital gateway to The Credit Experts Clients and our network and community, to access files, or other information in reference to their updates and credit repair status. Our Client portals are for our customers and can be accessed via a Web browser or mobile app 24/7/365.

Credit Monitoring Service

Credit monitoring services are companies you can pay to keep an eye on your credit files. The services notify you when they see activity in your credit files, so you can determine if that activity is a result of action you took or possibly fraudulent. These services range from $19.95 – $59.95.

Credit Repair Companies

Credit reports can be incredibly complicated. But while you can delete inaccurate information directly from an account, you are likely to find it hard and tedious. Credit repair companies can simplify your credit reporting and dispute your report immediately with credit agencies. With over 30 years of financial lending and evaluating credit, which led to lending out hundreds of millions in loans.

We evaluated credit before there was a credit score and have done tens of thousand of analysis on credit. So often we just want to know who to go to fix our problem, or money management advice from credit pros, but I’ve found that it’s far more beneficial to teach you about credit repair companies and how the credit repair industry works. Hopefully, you will decide to learn instead of only trusting a company to do what you can do with little bit of knowledge. However, as promised listed below are some of the more prominent credit repair agencies in cost:

.

What is a DIY Credit Repair Company?

A DIY credit repair company is a company that provides consumers with tools, resources, and guidance to repair their own credit reports without the need for professional credit repair services. These compare credit repair companies typically offer do-it-yourself credit repair software or online platforms that allow consumers to access their credit reports, dispute inaccurate or incomplete information, and monitor changes to their credit scores.

DIY credit repair companies often provide educational resources, and financial management tools including credit repair tips, credit education, and credit monitoring tools to help consumers improve their credit profiles. Some DIY credit repair companies may also offer credit counseling services or credit coaching to help consumers develop better credit habits and strategies.

While DIY credit monitoring and repair companies may be a more affordable alternative to professional credit repair services, it’s important to note that they may not be as effective as professional credit monitoring services, and there is no guarantee of success. Consumers should carefully evaluate the services and resources offered by DIY credit monitoring and repair companies, and consider seeking professional advice if they have complex credit issues or are unsure how to proceed.

What Are the Major Three Credit Reporting Agencies?

The three major credit reporting agencies in the United States are Equifax, Experian, and TransUnion. These three credit bureaus collect and maintain credit information on millions of consumers and businesses and use this information to generate credit reports and credit scores that are used by lenders and other financial institutions to evaluate creditworthiness.

Here’s a brief overview of each of the three major credit reporting agencies:

- Equifax: Equifax is one of the largest credit bureaus in the United States, and collects and maintains credit information on over 800 million consumers and businesses worldwide. Equifax provides credit reports and credit scores to businesses and consumers, as well as identity theft protection and fraud detection services.

- Experian: Experian is another major credit bureau that collects and maintains credit information on millions of consumers and businesses. Experian provides credit reports and credit scores, as well as credit monitoring services and identity theft protection.

- TransUnion: TransUnion is a global credit bureau that collects and maintains credit information on over 1 billion consumers worldwide. TransUnion provides credit reports and credit scores to businesses and consumers, as well as fraud detection and identity verification services.

Overall, Equifax, Experian, and TransUnion are the three major credit reporting agencies in the United States, and play a significant role in the credit industry by providing credit information to lenders and other financial institutions.

What are the best credit repair services available in 2024?

- Lexington Law

- Credit Saint

- Sky Blue Credit Repair

- The Credit Pros

- Ovation Credit Services

- Pyramid Credit Repair

- CreditRepair.com

- MSI Credit Solutions

- The Credit People

- Veracity Credit Consultants

- CreditFirm.net

- National Credit Fixers

- MyCreditGroup

- Blue Water Credit

- Credit Glory

- Innovative Credit Solutions

- Trinity Credit Services

- White, Jacobs, and Associates

- Prime Credit Advisors

- Fowler and Fowler Credit Repair

- Clean Credit USA

- Credit RX America

- Credit Absolute

- Creditmergency

- The Credit Repairmen

What is the Fair Credit Reporting Act?

The Fair Credit Reporting Act (FCRA) is a federal law in the United States that regulates the collection, dissemination, and use of consumer credit information by consumer reporting agencies (CRAs). The FCRA was enacted in 1970 to promote accuracy, fairness, and privacy of information contained in the files of consumer reporting agencies.

The FCRA provides consumers with certain rights regarding their credit information, including the right to obtain a free copy of their credit report from each of the three major credit reporting agencies (Equifax, Experian, and TransUnion) once per year, the right to dispute inaccurate or incomplete information in their credit reports, and the right to know who has accessed their credit report.

The FCRA also imposes certain obligations on CRAs, including the requirement to provide accurate and complete information, to investigate consumer disputes, and to notify consumers of negative information in their credit reports. In addition, the FCRA requires that CRAs obtain the consumer’s consent before providing their credit report to third parties, and imposes penalties for non-compliance.

Overall, the FCRA is an important law that provides consumers with protections and rights related to their credit information and sets standards for the accuracy and privacy of consumer credit reports.

Dispute inaccuracies with the credit bureaus

While your three credit bureaus’ report should reflect your actual accounts and other financial information, it can also be incomplete to provide accurate information. Maybe it was because your creditors didn’t know about it correctly. There is also another possibility of someone using your name for account opening. Tell me the best way to avoid identity theft. If you are having trouble finding the wrong information or it’s simply because you made a mistake or a theft, it’s worth it. Several major credit bureaus all have the ability to make complaints about inaccurate data in a given situation. Tell me the best way to get a complaint from each party.

- Credit Saint

- Sky Blue Credit Repair

- The Credit Pros

- Ovation Credit Services

- Pyramid Credit Repair

- CreditRepair.com

- MSI Credit Solutions

- The Credit People

- Veracity Credit Consultants

- CreditFirm.net

- National Credit Fixers

- MyCreditGroup

- Blue Water Credit

- Credit Glory

- Innovative Credit Solutions

- Trinity Credit Services

- White, Jacobs, and Associates

- Prime Credit Advisors

- Fowler and Fowler Credit Repair

- Clean Credit USA

- Credit RX America

- Credit Absolute

- Creditmergency

- The Credit Repairmen

Best Simple Credit Repair Options : Credit Saint

Credit Saint Pros & Cons: Credit Saint offers an extensive service for basic credit repair needs. A long history, solid reputation, and a good refund policy also exist for the business clients. Credit Saint has operated since 2004. It features rankings of different top personal finance manager financial websites and offers services such national credit direct such as personal finance advice and ongoing quarterly credit score training.

Best for Discounts: Ovation Credit Services

LendingTree’s Originations, Pros and Cons. Founded by an attorney, Ovation provides a trusted service that has helped improve more than 1 million customers’ credit profiles in 2021. Ovation offers two credit repair and three credit repair packages and plan options on the Internet.

Keep in Mind Credit Options

You can access a credit report from Experian credit karma, credit sesame or others. Find information on examining your free credit reports. Your credit report also should contain a few details about your past addresses, vehicles you own, and your loan history.

How do credit repair companies work?

Every credit repair company does something differently but the majority fast and credit repair process always follows four steps:

What you should know before hiring a credit repair company

You should take heed of a couple of factors when rebuilding your credit.

Credit repair companies can’t charge you in advance for their services

Once the company pays the initial setup cost, it cannot charge more money management even if the services they offer in a contract were performed.

Best Credit Repair Reviews

Monthly fees: $79.99 – 119.99 Set-up fee – $99 – 19.95 What made credit saint the best overall for us? The packages are priced from $79.99 to $19.99 and differ in how much claim they dispute / challenge each month — from five complaints on the “credit Poland”. Credit Saint provides free credit consultations with credit experts to assess credit score analysis your individual needs and identify the next steps. When you sign up for a service, the company assigned a team to your case and scheduled calls to inform you about the case.

Accurate information can’t be removed from your credit report

While many credit repair companies and agencies might try hard to clear your credit history, they cannot remove negative or inaccurate information from your account. It’s possible that they don’t want to delete the details of your reports.

Progress reports

Credit repair companies and credit pros can monitor your disputed items progress and update you frequently. They usually send a Progress report, as well as updated copies of your account history, to allow you to check your account changes. It is important to have credit repair cost and pros take into account a few things when repairing the credit history.

Consolidate Your Debt

It is possible to consolidate debts in a single account with a reduced interest rate. A debt settlement plan may be arranged by calling your creditors. You can consolidate your financial obligations by using credit card loans or personal loans. The consolidation of the debts can help you reduce the balances and reduce interest rates. This helps you avoid debt faster, getting rid of the debt. You may even find a way to resolve the debt by talking to your creditor’s representatives.

Credit Reporting Errors During COVID-19

It can be very difficult to find late payments for unused credit after the COVID-19 pandemic. Loans should not be marked as late or missed payments if your bank imposed a temporary restriction on the payments for the loan. Make sure your loan provider has the correct date for deferred payments – that is correct. If you don’t see the problem resolved, you can call an independent credit reporting agency for assistance with the issue.

Look for Personal Finance Tools

In addition to what credit repair companies offer their usual credit repair services, some credit repair services are available such financial management tools and personal finance tools, such as credit reporting software, credit management software and prepaid card payments. Similarly, they offer personalized credit counselling and identity theft prevention programs.

Check for Credit Repair Organizations Act (CROA) compliance

Credit repair agencies have a strict criterion. The legitimate credit repair company must supply a written statement detailing all the services provided and stating the time needed to achieve the result. In the event the contract does not meet your demands, the legitimate credit repair agency company may terminate your employment immediately without penalty.

How to Choose the Right Credit Repair Company?

When looking for a good credit repair business you must compare the service they offer. Consider the amount of dispute each month with a company and whether the company has a for free consultation or consulting tool for a personal finance manager, financial planning or perks for their employees. If there were any claims for damages in connection three other credit repair companies or packages, with such claims, the company would be able to get the one day money back guarantee back out of it.

You have the right to cancel any services without incurring any penalties within 3 business days

You the right to cancel your contract within 3 days with no charge. The FTC also requires this by its Cooling Off Rule.

Legitimate credit repair companies should include a copy of the Consumer Credit File Rights

Credit Repair Organizations Act (CROA) states credit repair companies have to provide a written contract describing services to you before you can receive any payments. Consumer credit records must be kept confidential in the case of unauthorized use, which is a form that informs you about your rights to obtain credit reports.

Open a Credit Repair Credit Card

Making missed payments is an effective way to improve your credit score. If you demonstrate you can make payments quickly, demonstrate to lenders your responsibilities. There are credit cards for those with poor credit scores, but some are designed for people with fewer credit ratings. This type of card is often referred to as secure card, meaning that a secure credit card allows access to money if your deposit is used as a security.

Free Credit Reports

Experian TransUnion and Equifax have offered credit reports every week until 2023. Take advantage of this opportunity and check your credit report for errors. Visit FreeCreditReport.com or Annualcreditreport.com. Keep in mind the free annual credit report will not offer any scores.

How does credit repair work?

Credit Repair checks your credit score to find any inaccurate information. It is an activity that is free for anyone who has the chance. However, it’s difficult to complete the report even though it has numerous errors. Credit Repair Service checks your credit report and calls the other top three credit bureaus, reporting agencies, other three credit bureaus themselves, and creditors in your favor. They could then ask for proof of the claim and then send letters challenging negative information from your report.

Most companies have setup fees

Most credit restoration companies charge a set-up or monthly fee based on the type of credit repair process. These fees are used in order to create an account that may involve gathering your personal and financial data.

Differences between debt settlement, credit repair and credit counseling

There are several methods for repairing credit. Debt settlement and credit recovery are all part of the personal financial sphere, although there are key differences. The National Institute for Credit Counseling can help you find the best debt counseling and credit monitoring service for your situation.

Research any regulatory action

Unless the a credit repair company or scam companies violate federal law they should not be regarded as a company. This information may be found on government-run websites like the FTC and CFPB. CFPB also offers a complaints system which allows users to find specific and name other credit repair companies and scam companies.

Is paying someone to fix your credit worth it?

How much money is necessary to fix credit is determined by your individual financial condition. It’s free for you to get a, free consultation, a free consultation, credit consultation from, free credit consultation and to get the best service from credit repair companies. A credit report is a report which provides credit reporting information in order for banks to investigate claims in a timely manner if the complaint is not filed. Credit repair can be a good solution if you have an inadequate credit rating. Credit repair is essential for a good life.

How long does it take to remove negative items from a credit report?

The time taken to remove an item from the a credit bureau or reports varies from the particular item to a credit bureau or report. In many situations, negative items can be retained on your credit report for a period of seven years. You could talk to a lender to eliminate the negative items sooner, especially if you pay back the money you owe or are still a current customer who made mistakes.

The Cost Of Lower Credit Scores

Bad credit can negatively affect the way we live. When it comes to a solid credit score, it does not mean you have access or you’ll be able to obtain credit. Some businesses are going to accept applicants who have fair or very poor credit, but at an interest rate higher. The poorer your credit score, the higher the costs. We will show you the amount of credit card debt you should expect based on your current credit rating. This is assuming 30-year fixed-rate mortgages worth $400,000, which represent a similar average price.

How long does it take to fix a 500 credit score?

Credit score building journeys can vary depending on a person, but shrewd spending may help you increase your credit rating to a high 700 in 6-18 years. Usually, loans will start to appear as soon as you have a 700 credit score.

What is a 609 dispute letter?

The 609 dispute letter highlights an inaccurate or incorrect report that forces credit providers to change it. You can find thousands of letters template on the web but this doesn’t guarantee that you will get any sort of settlement in your case.

How FICO Credit Scoring Works?

FICO® Scores are developed by Fair Isaac Corporation. The FICO® Score provided by ConsumerInfo.com, Inc., also referred to as Experian Consumer Services (“ECS”), in Experian CreditWorks℠, Credit Tracker℠ and/or your free Experian membership (as applicable) is based on FICO® Score 8, unless otherwise noted. Many but not all lenders use

FICO® Score 8.

In addition to the FICO® Score 8, we may offer and provide other base or industry-specific FICO® Scores (such as FICO® Auto Scores and FICO® Bankcard Scores). The other FICO® Scores made available are calculated from versions of the base and industry-specific FICO® Score models. There are many different credit scoring models that can give a different assessment of your credit rating and relative risk (risk of default) for the same credit report. Your lender or insurer may use a different FICO® Score than FICO® Score 8 or such other base or industry-specific FICO® Score, or another type of credit score altogether. Just remember that your credit rating is often the same even if the number is not.

For some consumers, however, the credit rating of FICO® Score 8 (or other FICO® Score) could vary from the score used by your lender. The statement that “90% of top lenders use FICO® Scores” is based on a third-party study of all versions of FICO® Scores sold to lenders, including but not limited to scores based on FICO® Score 8. Base FICO® Scores (including the FICO® Score 8) range from 300 to 850. Industry-specific FICO® Scores range from 250-900. Higher scores represent a greater likelihood that you’ll pay back your debts so you are viewed as being a lower credit risk to lenders. A lower FICO® Score indicates to lenders that you may be a higher credit risk.

There are three different major credit reporting agencies — the Experian credit bureau, TransUnion® and Equifax® — that maintain a record of your credit history known as your credit report. Your FICO® Score is based on the information in your credit report at the time it is requested. Your credit report information can vary from agency to agency because some lenders report your credit history to only one or two of the agencies. So your FICO® Score can vary if the information they have on file for you is different. Since the information in your report can change over time, your FICO® Score may also change.

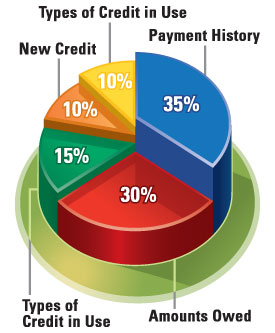

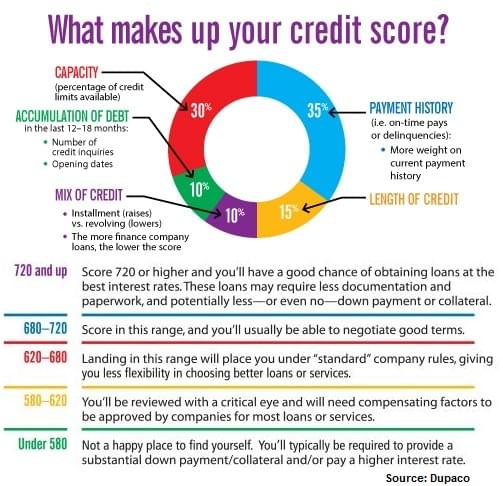

What Makes Up A Credit Score?

Your credit score is determined by an algorithm developed by the Fair Issue Corporation (hence its other name of FICO score). Three corporations, called “credit bureaus”, specialize in collecting and reporting on financial histories. Those three companies are Equifax, Experian and TransUnion. While, the exact formula used to calculate your credit score is a tightly guarded industry secret, these companies provide general guidelines about financial behavior that can affect your credit score.

Payment History

Thirty-five percent of your credit score is made up by your payment history. This includes late payments, collections, and even bankruptcies and tax liens. Each type of account will stay on your credit report a specified period of time and each type of derogatory will hurt your score differently. The Credit Experts works to remove accounts that are not 100% accurate OR not 100% verifiable. Our removal rate is around 70%.

Debt Ratio

Your debt ratio is the amount of revolving credit (i.e. credit cards) you owe in relation to the amount of credit you have available. For instance, if your credit limit is $10,000 and your current balance is $2,000, your debt ratio would be 20%. While, ideally, you would have your debt ratio at 0%, we usually recommend you are at least at 30% or lower.

Length of Credit

Your length of credit is how long you have had credit. At face value, this seems like something you couldn’t really do anything to fix. However, there are ways you can hurt yourself here. If you close out your older cards, even if they have higher interest rates, it will hurt your score. The credit scoring model has no memory or credit cards you close: if you close out that fifteen year old card you will get no credit for it!

Types of Credit

Types of credit include revolving, installment and mortgage loans. By having different kinds of credit open, you show creditors that you are responsible and able to handle different kinds of responsibilities.

Inquiries

Inquiries are marked on your credit report when you ask for new credit (i.e. when you apply for a home loan). Inquiries made by yourself or for unsolicited offers do not count against your score, but are shown on your report. It is important to note than when searching for a home you are allowed unlimited inquiries over a 45 day period since it is assumed you are rate shopping.

Fast Credit Repair

Fast credit repair refers to any method that promises to quickly improve a person’s credit score. However, it’s important to keep in mind that there is no quick fix for a low credit score and that most legitimate credit repair efforts take time and effort. In some cases, “fast” credit repair services may engage in questionable or illegal practices, such as removing accurate information from a credit report, which could have long-term consequences for a person’s credit. It’s best to work with a reputable credit counseling service or to take a comprehensive approach to improving credit that includes paying bills on time, reducing debt, and disputing errors on a credit report.

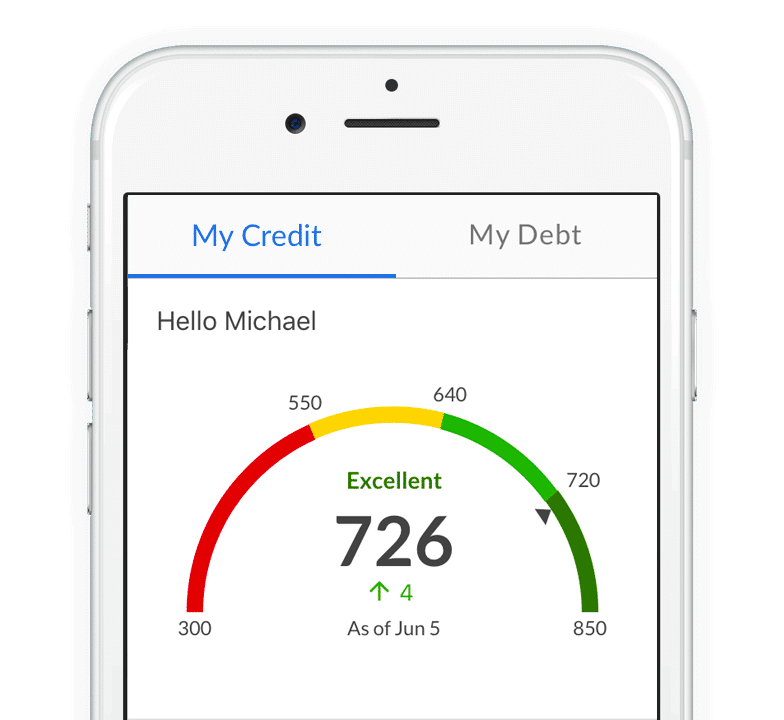

What Is A Credit Score?

A credit score predicts how likely you are to pay back a loan on time. Companies use a mathematical formula—called a scoring model—to create your credit score from the information in your credit report. It is important to know that you do not have just “one” credit score and there are many credit scores available to you as well as to lenders. Any credit score depends on the data used to calculate it, and may differ depending on the scoring model, the source of your credit history, the type of loan product, and even the day when it was calculated.

The majority of people understand the basics, like how failing to make a payment will cause your score to go down, but there are a number of complexities that trip up the average consumer. One of the main benefits of being a client with The Credit Experts, is that our credit repair services strongly believes in educating our clients. If you pay your debts on time, don’t carry too much debt on any one card, don’t close older accounts unless absolutely necessary and only apply for new credit when you have to you will generally be in good shape. However, it is important to keep yourself informed so you can maintain a credit score that accurately reflects your consumer status.

Lenders use your credit report in order to judge your reliability as a loan candidate. Your credit report indicates your ability to handle debt responsibly and will help banks decide if you are a desirable loan customer. A high credit score can help you lock in low APR rates or secure special deals on loans. A bad credit report may prevent you from securing loans and can damage your ability to buy a car, open a credit card or rent a home. A history of inability to manage your credit successfully will make lenders uncomfortable about trusting you with additional funds in the future.

You are entitled to a free copy of your credit report once a year, an offer you should take advantage of. When you do receive your credit report, check to ensure the figures are accurate and act quickly to correct any mistakes. This may include any clerical errors, identity theft issues or incorrect information. If your credit score is low, you should begin working on a financial rehabilitation plan, either on your own or with a certified debt counselor, to begin correcting your bad debt habits.

What is the average cost of a credit repair company?

Important things about credit repair journey have to remember. Credit repair is cheap for anyone who can manage the process. Generally when a customer uses a credit repairs firm they’re paying monthly fees, that range from $9 – $149 per monthly fee. You’ll never have any debt unless credit repair companies charge for services that you will not be able to make credit repair plans for yourself.

Is it worth paying someone to fix your credit?

If someone pays you for damage you are the best resource you have. No person has the right to remove a negative credit file without legal action and the best possible credit repair services that a full credit repair agency or clinic provides can easily be done without any costs.

What is the best company to fix your credit score?

Our Top Choice of Top Credit Repair Firms. Credit Saints: Probably the most best credit repair company overall. Lexington Law – Credit Repair Leaders. SkyBlue Credit – The Most Affordable. Creditpeople : the most best credit repair companies, with best assurances. Vation Credit Repairs – a better solution to get discounts. Credit pros – Best Bonuses Feature. Credit Versio – The most useful and fast credit repair and restoration service.

Our platform offers a range of features to help you improve your operations, including a user-friendly interface and advanced customization options.

Are credit repair companies legit?

Legitimate credit repair firms can help remove inaccurate data on monthly credit score and history, which could damage your credit report. They can do nothing else you cannot do yourself – or at a free of charge.

What Does the Federal Trade Commission have to do with Credit Repair Companies?

The Federal Trade Commission (FTC) plays a significant role in regulating the credit repair industry and protecting consumers from fraudulent and misleading credit repair practices. The FTC is an independent agency of the US government that enforces laws related to consumer protection, including the Fair Credit Reporting Act (FCRA) and the Credit Repair Organizations Act (CROA).

Under the FCRA, the FTC has the authority to investigate and penalize credit reporting agencies and other companies that violate consumer rights related to credit reporting. The FTC also provides guidance to consumers on how to obtain and dispute credit reports, and monitors the accuracy and completeness of credit reporting information.

Under the CROA, the FTC regulates credit repair companies and ensures that they comply with certain standards of conduct, including providing consumers with written contracts, disclosing their services and fees, and refraining from making false or misleading claims about their ability to improve consumers’ credit scores. The FTC has the authority to investigate and penalize credit repair companies that engage in fraudulent or deceptive practices.

Overall, the FTC plays an important role in regulating the credit repair industry and protecting consumers from unfair and deceptive practices. Consumers can file complaints with the FTC if they believe that a credit repair company has engaged in unlawful practices, and can also access resources and guidance on how to protect their credit rights.

Advanced productivity tools designed to help you get things done faster and more efficiently. With features like task management, time tracking, and collaboration tools. Learn more.

What Makes Up A Consumer Credit Score?

A consumer credit score is a numerical representation of a consumer’s creditworthiness based on their credit history. Credit scores are typically calculated using a formula developed by credit scoring companies, such as FICO or VantageScore, and are used by lenders and other financial institutions to determine the risk of extending credit to a consumer. The specific components that make up a consumer credit score may vary depending on the scoring model, but generally include the following:

- Payment history: This includes the consumer’s payment behavior, including on-time payments, late payments, missed payments, and delinquencies. Payment history is typically the most heavily weighted factor in credit scoring models.

- Credit utilization: This refers to the amount of credit a consumer is using relative to their available credit limit. A high credit utilization rate can negatively impact a credit score.

- Length of credit history: This includes the age of the consumer’s credit accounts, the length of time since their last credit activity, and the average age of all their accounts. A longer credit history is generally viewed as more favorable by lenders.

- Types of credit used: This refers to the mix of credit accounts a consumer has, including credit cards, loans, and mortgages. A diverse mix of credit types can be viewed positively by lenders.

- Recent credit inquiries: This includes the number of times a consumer has applied for credit recently. Multiple inquiries within a short period of time can be viewed negatively by lenders.

The specific weightings of these factors may vary depending on the credit scoring model used. It’s important to note that different lenders may also use different scoring models or may have their own internal, credit score analysis and evaluation processes.

Mastering Fast Credit Repair Services: A Comprehensive Guide

In the realm of personal finance, a robust credit score stands as a linchpin for accessing various financial opportunities. However, instances of credit report errors, missed payments, or excessive debt can damage one’s credit history. To address these concerns, individuals turn to credit repair companies for swift and effective solutions.

Understanding Credit Repair Companies: Credit repair companies specialize in aiding individuals to bolster their credit scores by rectifying inaccuracies, disputing errors, and implementing strategies to enhance creditworthiness. These services cater to those facing challenges due to errors, negative items, or insufficient credit history.

How Credit Repair Companies Work: Upon engagement, credit repair companies typically initiate their services by assessing an individual’s credit reports from major credit reporting agencies such as Experian, Equifax, and TransUnion. This meticulous examination includes scrutinizing credit history, credit utilization ratios, and credit accounts to devise a personalized plan.

Credit Repair Process: Credit repair services encompass various strategies. This involves drafting dispute letters to contest inaccuracies, negotiating with creditors, and advising individuals on optimizing their credit utilization ratio. Guidance on debt management and strategies for fostering a positive payment history also play a pivotal role in enhancing credit scores.

Choosing the Right Credit Repair Company: Selecting a credit repair company involves considering several factors. Look for legitimate entities that offer clear pricing structures, have proven track records, and maintain transparency in their processes. Assess their credibility by checking reviews, accreditations, and Better Business Bureau ratings.

Fees Associated with Credit Repair Services: Most credit repair companies charge monthly fees for their services. It’s imperative to grasp the costs involved before signing up and ensure that the services offered align with your specific credit repair needs.

Avoiding Credit Repair Scams: While numerous reputable credit repair companies exist, caution against red flags such as promises of instantaneous score improvements or demands for upfront fees before rendering services. Legitimate entities adhere to the Fair Credit Reporting Act (FCRA) and refrain from engaging in deceptive practices.

Improving Credit Scores Responsibly: While credit repair companies assist in rectifying errors, individuals must take proactive steps. Responsible money management, timely payments, maintaining low credit utilization ratios, and seeking guidance from credit counselors when necessary contribute significantly to improving credit scores.

Conclusion: Fast credit repair services offered by legitimate credit repair companies substantially aid individuals in rectifying errors and improving credit scores. By selecting reputable companies, understanding the process, and actively engaging in the credit repair journey, individuals pave the way toward a healthier financial future. Maintaining good credit requires an ongoing commitment to financial responsibility and prudent credit management.

Simple pricing plans

Choose the right pricing plan for your business, whether you’re just starting out or looking to upgrade.

Single

1 team member

$99

Save 50% – $199.00

- Feature one

- Feature two

- Feature three

- Feature four

- Feature five

Multiple

10 team members

$199

Save 50% – $399.00

- Feature one

- Feature two

- Feature three

- Feature four

- Feature five

Unlimited

100 team members

$299

Save 50% – $599.00

- Feature one

- Feature two

- Feature three

- Feature four

- Feature five

⭐️⭐️⭐️⭐️⭐️

Nice work on this product. You’ve saved our business! If you aren’t sure, always go for this product. Believe me, you won’t regret it.

Jess Brown

⭐️⭐️⭐️⭐️⭐️

Really good. This product is by far the most valuable business resource we have EVER purchased. Thanks guys, keep up the good work!

Shane Warne

⭐️⭐️⭐️⭐️⭐️

I don’t know what else to say. I don’t always clop, but when I do, it’s because of this product. This is simply unbelievable!

Sam Jones

Latest posts

-

Best Credit Repair Companies 2023

Best Credit Repair Companies: Top 10 Credit Fixing Services of 2023 *Recommended companies are usually charged a referral fee to our website. It has no effect on our reviews. If someone makes a mistake in submitting their credit score, it can cause you thousands of dollars in additional interest on your credit card. Although it…

Ready to get started?

Supercharge your credit with Ai Technology and development tools designed for optimal performance to improve credit and credit scores with machine learning algorithms .